Some Ideas on Obtaining Copy Of Bankruptcy Discharge Papers You Need To Know

Table of ContentsNot known Details About How To Obtain Bankruptcy Discharge Letter How How To Get Copy Of Bankruptcy Discharge Papers can Save You Time, Stress, and Money.The Only Guide to Copy Of Chapter 7 Discharge PapersA Biased View of Chapter 13 Discharge PapersEverything about How To Obtain Bankruptcy Discharge LetterThe Main Principles Of How Do I Get A Copy Of Bankruptcy Discharge Papers

One of the reasons people submit insolvency is to obtain a "discharge." A discharge is a court order which mentions that you do not need to pay the majority of your debts. Some debts can not be released. As an example, you can not release financial obligations for many taxes; child assistance; alimony; a lot of trainee lendings; court fines and criminal restitution; and personal injury triggered by driving drunk or drunk of medications.You can only receive a phase 7 discharge as soon as every eight years. Various other policies may use if you formerly received a discharge in a phase 13 instance. No person can make you pay a debt that has been discharged, yet you can voluntarily pay any type of debt you want to pay.

Obtaining Copy Of Bankruptcy Discharge Papers Fundamentals Explained

Some lenders hold a protected insurance claim (for instance, the financial institution that holds the home loan on your residence or the lender that has a lien on your vehicle). You do not have to pay a protected case if the financial debt is released, yet the financial institution can still take the home.

If you are a private as well as you are not represented by an attorney, the court has to hold a hearing to determine whether to authorize the reaffirmation agreement. The arrangement will certainly not be legally binding till the court authorizes it. If you declare a financial debt and afterwards fall short to pay it, you owe the financial debt the same as though there was no insolvency - https://www.madschool.edu.sg/profile/bankruptcydischargepapers8426/profile.

Some Known Questions About How Do I Get A Copy Of Bankruptcy Discharge Papers.

The creditor can likewise take lawsuit to recuperate a judgment versus you - https://penzu.com/p/4104d1c3. Changed 10/05.

To ask for court documents online, please complete the form listed below (https://www.figma.com/file/WqbP9GWv8wCqet7kKqORUK/b4nkrvptcydcp?node-id=0%3A1). If you are requesting to review court records at the courthouse, you will certainly be called when the case documents is available to assess. If you are requesting to acquire copies of court documents, you will be exposured to expense and also a shipment time estimate.

Do NOT send your social safety number, financial institution or charge card information with this site. The clerk can not guarantee the safety and security of information or documents sent out with this portal. In enhancement, any document, records, or files sent out to the staff through this site might be disclosed based on Florida's Public Records Regulation.

How To Get Copy Of Chapter 13 Discharge Papers Can Be Fun For Everyone

A Phase 13 insolvency discharge is a really powerful point. It stops your financial institutions from going after released debts permanently. It can also be confusing. Let's respond to several of the usual questions about the Phase 13 discharge. A "discharge" is the elegant legal term for your financial obligations being forgiven in your insolvency.

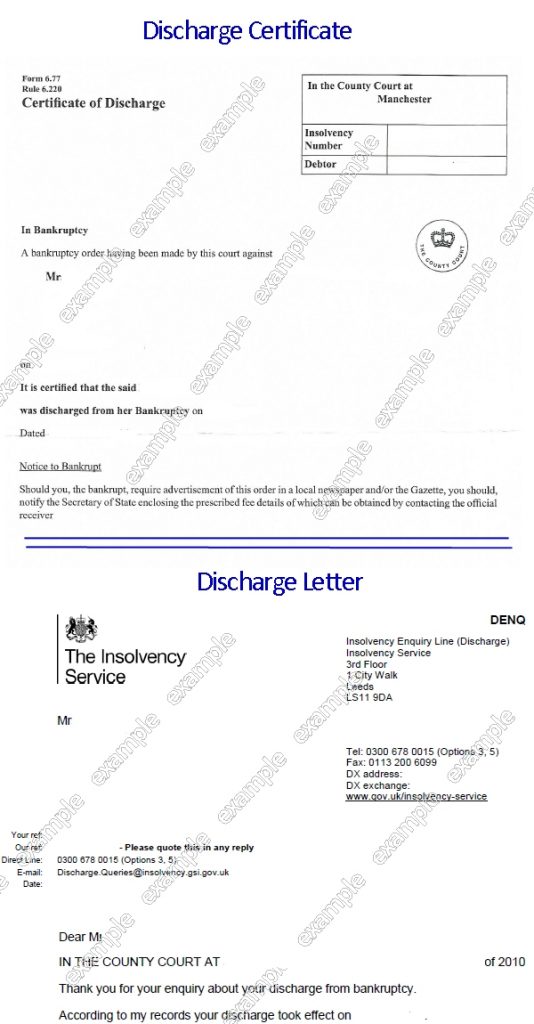

The Phase 13 "discharge order" is the last order you get in your Chapter 13 personal bankruptcy. It is authorized by the insolvency judge appointed to your situations as well as states plainly that you have actually received a Phase 13 discharge. In various other words, it is the formal document that launches here are the findings you of your financial obligations.

We need to keep in mind that there are two kinds of discharge under Chapter 13. The 2nd is called a "difficulty discharge" and is often called a Section 1328(b) discharge.

Not known Facts About How To Get Copy Of Bankruptcy Discharge Papers

While every court is slightly various, the Phase 13 discharge order looks similar. Once you get your discharge, your creditors are "urged" from seeking the financial obligation.

We commonly see this in instances where financial obligation collection firms remain to send out repayment demands even though the individual got the discharge. In these instances, we have taken legal action against the financial obligation collection agencies and won. The discharge is significant and also financial obligation collectors need to value it. No! One of the greatest aspects of bankruptcy is that your debt is released free of tax.

You would certainly have to pay tax on any kind of cash forgiven by the debt enthusiast. In bankruptcy, the discharge makes it so that the financial obligation mercy is not taxable. It's an audit problem for the financial institution.

Copy Of Chapter 7 Discharge Papers - The Facts

, but normally, you will get the discharge order concerning 1-3 months after completing your Chapter 13 strategy payments. The length of your Phase 13 strategy varies from instance to case.

A lot of financial debts are dischargeable in Chapter 13 with a few exceptions. We generally start by presuming the financial debt is dischargeable unless an exception applies. The typical exceptions to dischargeability are: The Chapter 13 discharge is far much more thorough than the Phase 7 discharge. Even more debts are dischargeable in Chapter 13 than in Chapter 7.